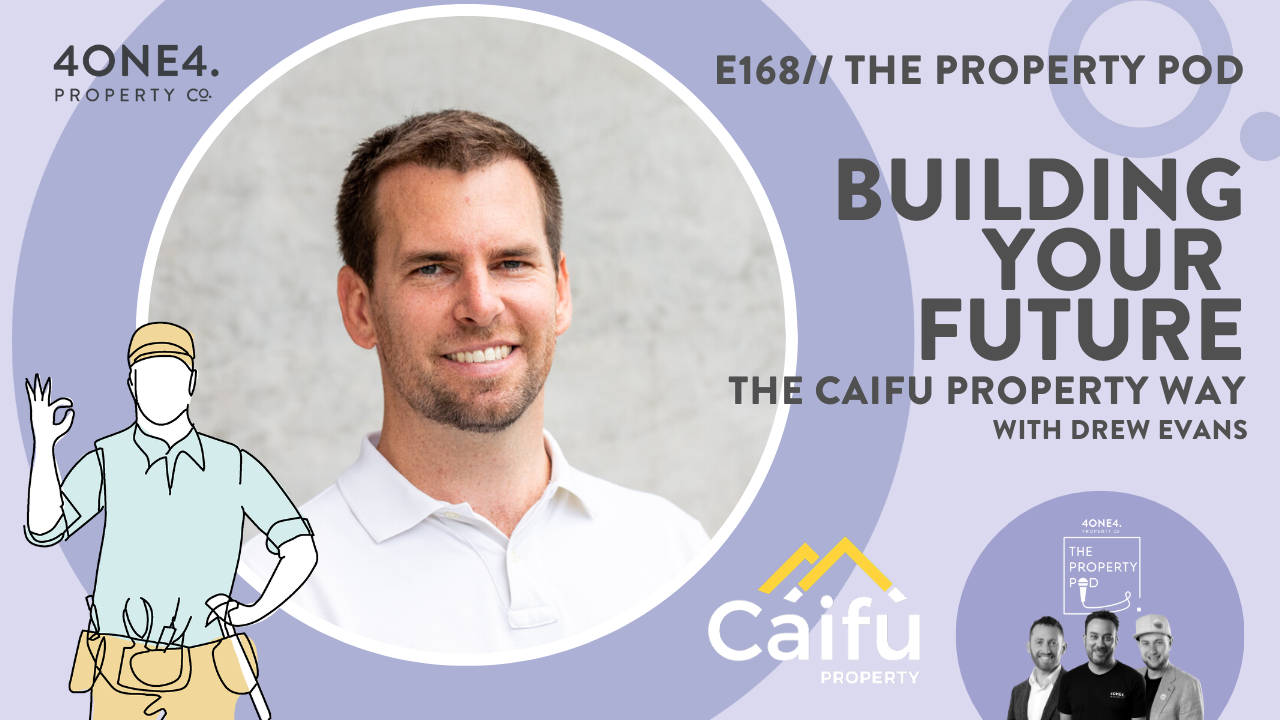

This week the Property Pod team are joined by Drew Evans, Director of Caifu Property. As an active property investor himself having built up a property portfolio valued at $25million over the last 10 years. He is passionate about helping his clients benefit from the same strategy that has fast-tracked his personal portfolio.

Listen in as Drew provides valuable advice on how to navigate the industry and achieve success. Whether you’re a seasoned professional or just starting out, this episode is a great resource for anyone looking to enhance their knowledge and skills in the real estate market. Tune in now to learn from the best in the business!

Find out more about Drew and the Caifu Property Team here:

@caifuproperty

Caifu Property Facebook

www.caifuproperty.com.au

Transcript

Drew Evans

The first thing you need to do is to catch up on strategies to understand, well, what are your goals? What are your objectives, and what are you trying to achieve? So you want to go to one. So you’re listening to the bar.

Aaron Horne

All right, guys, welcome back to the property pod, your weekly engagement into real estate here in the Hobart marketplace. I’m your.

Drew Evans

Host, Evan Horn, and I.

Aaron Horne

Am joined by Patrick Berry for this very first part of the episode today. Welcome. Patrick Berry It’s a real mix of an episode this way, isn’t it? It’s kind of like a it’s like a guess who game or bingo card of who’s here, who’s not here, who’s who’s talking, who’s not talking. Today we’ve got a very special guest.

Aaron Horne

Drew Evans from Classic Property is going to be on the podcast. But while Drew’s on the show, I won’t be and John will appear and John will show up in his chat. So, yeah, funnily enough, just getting everything and everyone’s ducks in a line. It’s a it’s a busy time for real estate. Spring has sprung and things are going gangbusters.

Aaron Horne

So yeah, John’s out getting deal signed when we hope that’s what he’s doing. Just turned out this morning. That’s alright. It’s alright. He’s out doing things. Yeah. When the recording was happening with Drew, I was off having a baby scan for my baby, which is due very soon. So coming up forward in the probably part, you might be finding a bit of a rotating chair scenario going on.

Aaron Horne

There might be a bit, a little bit of that. So if you’ve got a favorite and they’re not in, don’t blame me, blame the baby. But the good news is I’m here for the whole website, guys. Exactly. Yeah, I’m here for the now and I’m here for the interview that was last week. Ended. Yeah, the backbone that holds it all together.

Aaron Horne

So I drew it. Really interesting guy. We’ve connected with Drew through some other people and they’ve mentioned Drew would be a really good guest on your podcast. What I might do is just literally cut straight to Pat asking Drew, Joe, tell us all about yourself. Sounds like your go. All right, guys. Drew Evans from Coffey Property. Well, thanks a lot.

Aaron Horne

We have a story. Want to give us a quick rundown on a bit about your background and how you got into property development and how you create wealth at the moment.

Drew Evans

Yeah. So I’ve got a bit of a love story at all. I’ll give you the short version. Of course, I’ve got a bit of a twang in my accent and the reason behind that is I grew up in Zimbabwe, which is if you don’t know just about South Africa. I was a boarding school at the time and unfortunately my my old bank are very badly beaten up as a result of the land distribution.

Drew Evans

The regime not get a political.

Patrick Berry

Oh yeah.

Drew Evans

Yeah. At that point and I’m I’m an etc. you don’t go back to school your brother and sister and you are going to Australia pack your bags. We’re all so in 2001 that we moved across to, to Newcastle Australia and I guess from there the rest is history. Always had a sort of entrepreneurial side to it. So what I do, and that’s the big oil banner and but I guess how my property sort of journey started was really what they felt.

Drew Evans

And I wasn’t fortunate to be smart enough to get to university, to afford to be able to get into university straight away. So what happened was I went to a business college and then the other credits to get into uni. Long story short, my parents didn’t have to pay the exorbitant international student face. Yeah, but what I did get to getting we kind of struck a deal with I said, Hey, you’ve got a bunch of buddies that need accommodation.

Drew Evans

We want to invest in a property. You know, you make it happen, you look after the property and you get free rent. And that kind of sparked my interest in property because what we did when I say we, my parents bankroll themselves as to yes. So one day they bought a four bedroom house and then over the holidays we converted it into a seven bedroom house, rented it out.

Drew Evans

Right. So that’s all I think is 110 or $150 per student per annum. That included obviously your drinking water, the water, electricity, internet, that kind of thing. Yeah, they did so well out of that cash flow where they wanted another one and that kind of spotlight interest in your property. Like you correctly said, John, there are a lot of sort of shots in this industry approaching.

Drew Evans

And I guess my experience I started while working for other people and it taught me exactly what not to do. Yeah, with Newcastle’s biggest house and land developer, I then moved to Sydney and started working for the country’s biggest education company in the public space. And long story short, I did my time there and I thought, Hey, I do this bigger and better myself.

Drew Evans

And in 2015 I founded corporate property. At that time I’m pretty lucky because my property portfolio produced enough positive cash flow to land and quit my job set up company. And here we are. I don’t know. And it’s light up.

Aaron Horne

So I guess I’m I’m curious, how did you get into buying your first property? Like everyone that we talk to, you know, they love the idea of buying their first home and even more so. I love the idea of having a portfolio of investment properties that a lot of people find it really hard to, you know, first get into the market, let alone step up and buy the second or the third and so on.

Aaron Horne

So like how how does one go about that, I guess.

Drew Evans

Yeah. And Patrick, it’s a good question because the first one’s always the hardest, but it’s very exciting because you have to slave your way to get it. In Australia, if you had a good income, you paid good amount of tax, you then got to live. You think of a save and it’s it’s a really tough gig. So, you know, I worked three different jobs, set up the deposit, I negotiated that the Developers Commission was used as bottom line and wasn’t creative.

Aaron Horne

I like that.

Drew Evans

Yeah we got a lot of and it happened purely by people, you know, now it’s really tough to go and kids honestly don’t know how they’re going to get into the property market as opposed to through the bank of mum and dad. But yeah, if any of your listeners are struggling inside of a deposit, there’s a really cool product now called the Family Guarantee Support letter, which I don’t know if you guys have heard about in Australia.

Aaron Horne

We have heard about it through some of the finance people that we talked to. But yeah, we haven’t really on the show delved into it in really much detail. Yeah.

Drew Evans

Yeah. Well I mean I’m not allowed to talk about in detail, but I had one time again, you know what, I slide my testimony on my first deposit, probably just cause I’m hardworking by nature. Yeah, but the spotlight to do it is if you do have parents or family that do have lazy equity in their property, you can leverage all their equity and.

Aaron Horne

Utilize it to get in. And then I guess the theory is that after a couple of years when you build some equity up, you can release your parents from that and go your own way.

Drew Evans

That is one of the best things about my company. How we help our clients is, you know, you can use your parent’s equity initially to get you into the market cities, the projects completed, get a refinance, give your folks the equity back and.

Aaron Horne

Then you’re on your way.

Drew Evans

Right? Yeah.

Aaron Horne

Yeah. That’s a really cool approach and a great way of doing it. And so from what I was lucky enough to listen to a couple of other podcasts you’ve done before, we got on Zoom today, and what I could understand from some of the other conversations you’ve had, you’re more in the developing the project from start to finish aspect rather than going out and buying a finished product tightly.

Drew Evans

I mean, my business philosophy is to never invest the retail client like you always want to invest wholesale.

Aaron Horne

Yeah, I love that analogy.

Patrick Berry

Yeah because that was not I had to is as wholesale investors in controlling the margin I guess it’s sort of what triggered me in that first time, you know, an intro to you.

Drew Evans

I mean that’s, that’s a good tagline. You get to control the logic, which is so true. I mean, if you buy, you buy an existing property, right? Not that there’s anything wrong with that at all, but you think about it, the land developers made money and builders made money or developers made money or real estate agents made money.

Drew Evans

And then I guess you, the guy at the end purchased everybody else’s capital growth. Whereas my investment philosophy is to try and control much of that margin as possible on behalf of our clients. So our investment philosophy is to find opportunities that are essentially under market value that you can add value to through doing a small development, whether that’s a house or duplex or subdivision.

Drew Evans

But at the end you have an equity advantage already. So you have an option. You can either take the title so that always knows or be get the property revalued and use the equity generated. It’s been rolled your next project.

Patrick Berry

And came over and yeah.

Drew Evans

Because at the end of the day the last thing you want to be is stock price. And unfortunately that’s the crazy stat. It’s something like five or 6% of investors get passed three properties like this. It’s not a huge amount. And realistically when you got the property, it’s all about understanding how you can get the finance to work first and then the property comes second.

Aaron Horne

Yeah, and you’re right with that because we have we’ve, we manage close to 920 950 rentals here now agency and most of them most of our bigger investors they are two property investors like there’s not a huge amount that five or six in their portfolio but they do well enough to buy the first one refinance, get the second, but then they sort of hit a stalemate or hit a brick wall.

Aaron Horne

And it’s hard to get that next step.

Drew Evans

It always used to bug me like, you know, I’d sit around and, you know, I love, you know, self-development, impressive development and following very successful people and always used to bug me how, you know, some people get stuck at one or two investments. Once you’ve got other people that have ten, 20, like, you know, look like pretty ridiculously so on a 250 properties, you got to hope.

Drew Evans

You know, he’s not definitive, mate. You just obviously know something that I don’t it and and and he had to do it and I’m a big big believer that is you should follow people that have achieved what you want to you know there’s no point trying to make all the mistakes yourself and learn yourself when you can fast track your success.

Patrick Berry

Against one of the things you do when you’re chatting about your story. Before it was like investing with your ego. Yeah. And you know, could you expand on that a little bit? Because I know recently, I mean, I’ve made that mistake just recently where I’d intended to do, you know, I’d bought a house with the capacity to start at the bank.

Patrick Berry

But, you know, getting into a new relationship are going to start a little bit longer. I’ll put in a way more expensive kitchen than I should have, but also to, you know, remember chatting with a mate who’s an architect. And I got a little bit excited by these different designs, which is just insane. Like was just I made all the my all the wrong mistakes.

Patrick Berry

Just following what I thought would be cool and with my ego is, is that what what how can that be really prohibitive then, and how can you catch yourself to that while he’s expanding.

Drew Evans

Portfolio like, well, I’ve got two stories for other and the first one, well, they’re both embarrassing a lot of.

Patrick Berry

Let’s go tit for tat.

Drew Evans

Yeah, the first one was I had my first about what I did was I built a two, four, four bedroom house with a major subdivision. And mistake I made is I got an architect involved redesign of the homes the way that I one of them was this piece of land. And the story there is I spent 45 grand or something like that on landscaping.

Drew Evans

And when it was finished, a quick set walking in the car drove past and hey, look at me, I’m a developer. I look like a genius. I’ll tell you what, I wish I didn’t take her down that three months after.

Patrick Berry

Yeah, huge waste.

Drew Evans

But when a tenant is that much like a writer. So for me, that was a learning lesson in developing is you can throw good money after bad and you can you can lose money by either capitalizing the second not so good story. He’s a really good friend of mine. Use my company to help develop duplex tenants. He’s talking to my team and my team recommended an area to do a duplex and the total acquisition price at the time was seven 790 grand.

Drew Evans

Yeah, so 800 old enough stamps and that sort of thing. I drove out and I said, Mike, listen, this place is very, very early in my head. Based on the demographic I do probably better places to invest once to a shorter period. And to my advice, yeah, I never hear the end of it. Every time we catch up in another client where just the property and by the time the project was completed, each duplex half was worth 650 grand and aside.

Aaron Horne

It’s only $400,000 lost.

Drew Evans

I got a flat on a grand yet. So it’s always harder because when you invest in property it inside personal and it’s not like to go down to the pub and just chatting about a couple of drinks. It’s a big deal. It’s a lot of money that’s involved. And as much as you try and say I had done the emotional about it, it is a big decision and that’s one of my biggest lessons of these high.

Drew Evans

You know, there’s people that spend a lot of time in a resource, understand a fundamental understanding the market that do a better job than I do. Yeah, you know, so sometimes you have to let the numbers do it. And talking, especially when it comes to developing and what life is cheapest takes the whole and it’s just that.

Aaron Horne

So talking about understanding the market and researching the market for a investor that’s getting into it, like is there some places that you would recommend that people can go to obtain this information? Obviously, they’re listening to us, so they’re in the right space already. But you know, there’s plenty of resources out there these days. And look, as silly as it sounds like, you can get property information these days from Tik Tok to sitting there not in your couch.

Aaron Horne

But is there reliable sources that you should be probably spending time signing up to newsletters or research or or places that can give you the Head Start and where you should be looking into it?

Drew Evans

Without a doubt. I mean, my biggest advice is the biggest investment. You should make it yourself, but it’s in between these two things. So listen your past podcast, Other people’s podcast. But when it comes to the type of research that we do is all factors together, it’s not hearsay, it’s not paid for by market commentators. And fortunately, a lot of, you know, people out, they get this is a.

Patrick Berry

Long way and.

Drew Evans

We sort our research problem, which is pinched from by a research company saying, hey, property investing should be as easy as pie and with pay stubs for the population increase. So you want to be investing in areas that have a huge population growth areas.

Aaron Horne

How about.

Drew Evans

Yeah, I know I need more structure. So you want to make sure that lots of money is getting spent both public and private.

Aaron Horne

Which is interesting because Hobart ticks that box. So we’ve got some of the biggest infrastructure projects in Australia underway at the moment. So it’s interesting.

Drew Evans

Certainly I mean great spot, like the timing of my lot is maybe a little bit, which is like that earlier, but certainly is is what it’s going to be close to jobs now to be honest, guys, you can sit on the Internet and have fun and stuff. So we call those little barrier islands. Yep. The income level in which will make it micro microdroplets.

Drew Evans

And these are things like the dice on the comparable sales, not what a real estate agent gives you surprises, but what’s done doesn’t settle on the data yet. But the demographics about the vacancy rates, these are the things that again, you can sit on the Internet where I guess like companies are taken to the next level is focusing on the next drivers and the next drivers all around.

Drew Evans

Well, how do you get the highest and best use for whatever you’re developing? Classic example, if you find a book dead, are you better off developing an eight bed full by two car design duplex? All based on the demographic? Are you better off losing a bedroom to get an extra garage space? So are you better off developing a 6.4 by four car based on the demographic?

Patrick Berry

Yeah, that makes sense.

Drew Evans

You always want to make sure that you have the right street frontage. You have the right setbacks. You always want to actually maximize the building that you then have to comply with all the design guidelines to make sure you get the minimum. Some like some like Alice in the backyard. Yep. The right acoustics, the white basic. So there’s a huge amount of things in development you need to know.

Drew Evans

And unfortunately, investing in property with the strategy that I do, it can be very, very expensive if you get it wrong. And I guess that’s why I put a business and we have a job.

Patrick Berry

Because I guess what’s important in that point is, is something as simple as in one of the other stories you said before was thinking that you’ve bought a a land on a slight slope, which you thought would be a piece of cake. No drama. Yeah. The problem is, is that that again forces your hand and what you have to do and the cost that you need to just to get the same value, but the investment of building that greatly, you know it into a profit.

Drew Evans

Yeah, massively. So obviously. I mean you can go on to say that well you just have to have a specific design. There’s only a handful of builders that specialize in that style of construction, but even if you do have a slightly sloping local office and based in retirement, then it’s extra cost to do a split level home. You’ve got a storage bay which you have to factor in.

Drew Evans

Everything when it comes to building has associated costs and these costs don’t always replicate additional value and retaining walls is a really good one. John So I guess when you do your feasibility on any type of acquisition, the slug of the land is a massive factor that need to take it.

Aaron Horne

And I can guarantee it is something nobody thinks about and they go into these building websites like Metricon and that and metricon quote These prices. Then in the very fine print, it says on a level block of land, you know, everything’s sorted. Yeah. So it’s and you talk to the general person, you can even walk on a block of land and it seems relatively flat, but it’s not until the levels are done by, you know, the surveyor and you realize this is actually got more fold than I realize.

Aaron Horne

So yeah, that.

Drew Evans

That’s a really good tip. Your listeners, right? Don’t stand on the block Always ask the solicitor control plans and tip of the day is the closer the squiggly lines are.

Aaron Horne

The better. Yeah, that’s.

Drew Evans

What you want them far away from each other.

Patrick Berry

Actually, I know I’m going to stay, you know, take a couple of steps back because, you know, going right to the weeds, but if you will, the thought being if you’re, you know, you you’re trying to save up for that first deposit. And you look at a company in an opportunity like yours and I think, oh, I’m just not at the level where I could gauge with a person like yourself, what would you say to some person is, look, I just want I’m ready to start.

Patrick Berry

Should I work with you first or should I wait? What? You know, what’s your normal answer to a person beginning?

Drew Evans

Well, let’s be honest. My answer is, hey, there’s 100 twice by buying a property. There really is. It just comes down to what your individual strategy of developing self, right? I know for me it’s the best strategy I need to fast track any results. You know, I get rid of all my brother all the time. I have no idea how to swing a hammer.

Drew Evans

But honestly, I’m write about my own house and I’ve been in hospital twice already. So for me, I’m not a tradie. I can’t renovate for somebody to start it. Yeah, it’s getting clearer in your mind, but what do you do? You need to kind of begin with the end in mind and then formulate how you best going to get there.

Drew Evans

And as we sort of mentioned before, you need to understand property investing is a finance game Initially, until you build up the borrowing capacity in the buying power, it’s getting a clear idea of saying, Hey, listen, what’s my capacity to write? And if I take on this property, whether it’s a development, whether it’s a house, a townhouse renovation project, does it matter?

Drew Evans

But is this project going to set me up or is it going to send me back to the one after that and the one after that? And I think as long as you always have it in the back of your mind, what’s next? That’s a really good sort of starting.

Patrick Berry

Point that makes sense because I suppose we’re so if we see a pattern on, we’re going to go in together and we’re just and we we’re we don’t want your office. Right. Can you walk us through how you know what it is, what you do and what your company does? You know, what we going to take up now because it’s going to take forever.

Patrick Berry

Well, we scope out. Yeah, but what’s what’s the journey you take us on?

Drew Evans

Yeah, sure. So the first point is we have to understand what’s your finance capacity? You know, I have an automatic equity program which there’s a fee associated with it of, of finance. Now, I never want to take any money or anybody. I kind of genuinely show you how I can add value to you. Bottom line. Yeah. I’m in the same respect.

Drew Evans

You have to show me that you can afford the types of opportunities that we have. Otherwise life’s a waste of money and a potential I with the both of us. So we need to do that research. You do that. You do this to see exactly what’s possible. And we need to make sure that what one business does is in line with your goals.

Drew Evans

Because if it’s not, again, we’re kind of wasting each other’s time. But let’s assume that you do have a finance capacity and you do want to come on board. The first thing that you need to do is to catch up with the strategies to understand, well, what are your goals, what are your objectives, and what are you trying to achieve now that has implications in relation to what type of finance do you need to get, What type of deposit you need to work out?

Drew Evans

What is your purchasing entity detail? Are you going to hold a project for the long term? We better maximizing the tax advantages by having it in your own at all. Are you going to buy, develop, sell and trade? Do I to get a bigger deposit? And if that’s the case, maybe investing in a company is a better structure for you because you’re getting a tax like capital 30%, you climb the margin scheme and so on.

Drew Evans

So that’s pretty net. But again, it’s a case of you need to think twice, once, get on the same page with exactly what’s possible. Once you know your strategy, you know the game plan, then it’s a case of working with our property guys to figure out, well, which is the best market, which is the best opportunity and which is the best project to fulfill.

Drew Evans

Well, one of my favorite strategies at the moment now is is building a development pipeline where essentially you try and control as many development as you can without necessarily having to take them all at once. And again, this isn’t the big muscle brag or come across like a douchebag. I can relate to it. I’ve got ten projects in the pipeline now.

Drew Evans

Of the ten, six are either settled in council under construction, then in two months I sell them on the two projects and then in June of next year I’ll settle another two. So my basic philosophy that is to always have a rolling pipeline of ten, because for me that’s the way that it will have identified opportunities to generate big chunks of capital in a relatively, relatively short amount of time.

Patrick Berry

But obviously, you know, you you’ve been able to build up to that level. Of course, you know, go back to, you know, the finance, the the potential. So I guess in that sense then from, you know, the pattern of being cards, there’s no reason why we can’t get to that stage. But it’s that first step is it? Don’t expect you’re going to be doing it to unit development from day one.

Patrick Berry

And you look at it with your business is a way you looked at that first project and finished. We I mean, and then getting on the base and then a real estate. But we’re not going to pretend we know more than we do and we effectively have to say to you, okay, we’ll just we’ve just closed up for the next one.

Patrick Berry

We want to we want to double in. Is it almost the point where, you know, your stuff, we don’t want to say, well, actually, well, we’re the guys with the hammer. We have no idea what to do with the site. We just hand handed over to you and you take umbrage at the point or the week. And so all the way through.

Drew Evans

John, yes or no? You know what my advice to everybody is? Hi. Listen, even though it’s my company, it’s my brand, is my reputation, I’m super comfortable and comprehend everything that my team does. And at the end of the day, it’s it’s your money that you’re investing. So you guys have to be comfortable, right? I don’t have a crystal ball.

Drew Evans

I don’t know what’s going to happen in the future. But what I do know is that every property we source is secure, has an instant equity advantage at the time of acquisition. Right. So if the market does drop like we’re experiencing at the moment now, it has to drop while that initial level of equity for the property to be worth what you’ve actually paid for it right from the get go.

Drew Evans

Yeah. And so the reason I say yes or no is honestly, I’ve got a lot of clients that tumble professionals. They’re super switched on by money. They just don’t have the time, the skills, the experience, the industry contacts bring it all together. And I guess once we spend a bit of time getting to know each other, they understand our business model that understand how we work through you guys, the experts, you and your team.

Drew Evans

Please go ahead and do it. Let me know what I need to do. Like now, that’s the one extreme. On the other extreme, obviously, we’ve got contact ahead of some really interested in this stuff. I really want to understand what’s the behind the scenes, How does it work? How do you have great council meetings? How do you deal with look at itself planets?

Drew Evans

What are some of the other consults I need to do in order to get the development across the line? So it’s kind of this broad spectrum where my company, it’s not an education company where you pay a stupid amount of money to become a client at a price bootcamp seminar, and then you get so good about 30 day course, but you can actually get educated by dealing with my team one on one.

Drew Evans

And obviously the theory is for us, if we can help you make as much money as possible, your first acquisition, it’s an absolute no brainer to come back to.

Aaron Horne

Us to do a second one.

Drew Evans

Yeah, I.

Patrick Berry

Know that because it just look, yes, you can do that. How we earn money is through you investing with us, but we’re not just flogging you off some credit course in there. Doing yourself designing. What’s that thing where the most dangerous spot to be in is to not know what? You don’t know that. What’s that? Science. You know, it’s amazing when you think you know more than you do.

Patrick Berry

Way too smart, I guess. I guess is not all of those courses just make you set yourself up feeling like you’re an expert, but you still don’t have any connections, you still don’t have an experience. And so the thing is, if you allow yourself with your companies, like we’re still educated, but we do the work at the same time, so we’re both in it to make a profit.

Patrick Berry

At this point. Your properties and my just the slogan and of course they just keep going to the.

Drew Evans

Inside is about I come across the role where we know the merits of the projects that we do. It’s only a matter of time before somebody doesn’t, but one way or another they’re going to get done. So I guess, I don’t know. I have a very long time in my business and I’m a very, I guess long term relationship buys quite a lot of things because I know that if you get the results from a company you first project and you have a bloody good experience, not only are you going to get your second, third, fifth, but you’re going to look at family and friends and and that’s how, you know, I guess the company

Drew Evans

that I’ve got is kind of science fair even in these parts because of the brand values that we do have. You know, I don’t have a vested interest in selling you a property and then you never hear from me again. Yeah. What I’ve learned is, you know, your your word is your bond and your that bond is everything.

Drew Evans

So what did Warren Buffett say? It takes a lot of time to go to reputation. And I think one or two bad decisions 300 and know when I when I talk to clients this is a bit old topic but as I listen to by the minute you’re in a pub, I want to make sure that Yvonne Longshots blossoming.

Patrick Berry

Good. I like that. Yeah, yeah, yeah. So like not so we’re not really knowledgeable if someone’s going to reach an engagement, what’s the best way for them to get in contact and what’s, that’s what they telling me.

Drew Evans

So I mean the best way for constant to sort of stop calling what we do is just jump on Instagram. Top advice for I’m still trying to figure out to talk to got a job up for told year old at the moment because I’m trying to figure it out but yeah jump on any of the socials. Yeah she does at the end.

Drew Evans

Jump on our website. It starts by getting educated, see what we do. We’re not for everyone. But I’ll tell you what, if you are looking at a done for me solution with wholesale property development, you know, I think the that my company is one of the best there is.

Patrick Berry

My thanks so much Eric it’s been a big fan of you. I would love to have you back on the gates a couple big doors on different parts of that process in the future. That’s a lot.

Drew Evans

Yeah, that’d be great. I mean, now we’ll do another time. It’s in these times Why Strategy works incredibly well, especially with the duplex environment where, you know, you get into a duplex, you hold the project goes up value and if cash flow becomes a topic as interest rate rises, the beauty of the strategy is you can sell one and keep on use the money you make on the sale of this one to pay down the debt on the other one.

Drew Evans

And I’m going to life plan example. I did just that and he made over 250 grand on the sale. They use the property down the debt on the one that he owns and now he just writes a 15.2% return on his debt. So I would love to tell you more about that. Well, it’s.

Patrick Berry

It’s it’s such a good time. It, too, because, Laurie, one of our other agents was chatting to me about this, just a small little two bedroom unit that we’ve got for sale. And, you know, you just you just had all the returns that you used to be able to just do in Tasmania got going on that just gone.

Patrick Berry

So really the only way to do that extra yield and return it is exactly what you just said. And I think it was actually from listening to he’s sort of led me to have that conversation with ourselves. I think the same at well, if that’s what the investors doing that issues that’s just gone and I need to find a different strategy so that takes about for me to present this right now.

Drew Evans

I said to you guys.

Aaron Horne

Thank you very much and enjoy that game of golf you’re heading off to. It looks pretty good up there. The Shintaro that. Yeah. Thank you. Thanks. Hey, sir, we really appreciate it.

Drew Evans

I got to.

Aaron Horne

Say, you have been listening to the property both recorded and edited by four wonderful media house in conjunction with the full and full property code. This podcast is general Information only, and the thoughts of views expressed is the opinion of our panel. And listeners should always then use their own investigation into any topic we discuss to ensure they fully understand their own situation.

Aaron Horne

It does not constitute.

Patrick Berry

And should not be relied.

John McGregor

On as purchasing, selling, financial or investment advice or recommendations expressed or implied, and it should not be used as an invitation to take up any agent or investment services. No investment decision or activity should be undertaken on the basis of this information without first seeking qualified and professional advice.